The Quickest Way to Get Payday Loans

Payday loans come in handy when you are in need of quick cash. That explains why they continue being so popular among middle-income earners. You can qualify for payday loans when you have a credit score that is above average. In some cases, you could always find a way to get payday loans even with bad credit. When qualifying for the loan is out of the question, your next issue will be to try finding the most convenient way to get the money you need when you actually have the use of it. Delays in getting money could be quite costly. For instance, when an opportunity slips by you may need to spend more money to chase after it.

Seek help

When you have bad credit or issues with your ability to quality, seek help so that someone else with a thorough knowledge of the industry could help you. Be polite to your correspondence with the lender. Find an intermediary firm that helps consolidate your loans to improve your credit score so that you enter the good books of payday loan lenders.

Check requirements

You can tell the ease of getting a payday loan by the number of documents relating to your credit score that a lender requires. Lenders who only require your online application are more likely to offer an immediate response to your payday loan application. They could decline it but still give you an immediate response. Always consider such options before going to fill lengthy forms that may not lead you to quick cash. On the other hand, it is useful to also check with lenders who already promise immediate action when you offer pertinent documentation.

Boosting your credit rating

Your credit rating is another factor affecting the speed of attaining the money you seek. Therefore, pay your other loans on time even if you are just doing the minimum payment. Remember to update your records with your lender too. These two steps are critical to the credit rating you get, and that rating affects the speed. You must approach the game as though you are the best client.

Your credit rating is another factor affecting the speed of attaining the money you seek. Therefore, pay your other loans on time even if you are just doing the minimum payment. Remember to update your records with your lender too. These two steps are critical to the credit rating you get, and that rating affects the speed. You must approach the game as though you are the best client.

Relying on your previous lenders

Previous lenders already have your details. It also cost them less in terms of advertising because they do not need to convince you much about their services. Not to mention that they wish to retain you as a customer. Take advantage of their willingness to give you money to top your existing loan or as a new payday loan. Many people soon realize that the lenders are actually friendly businesses that are willing to negotiate payment rates as long as you keep your end of the bargain as a borrower.…

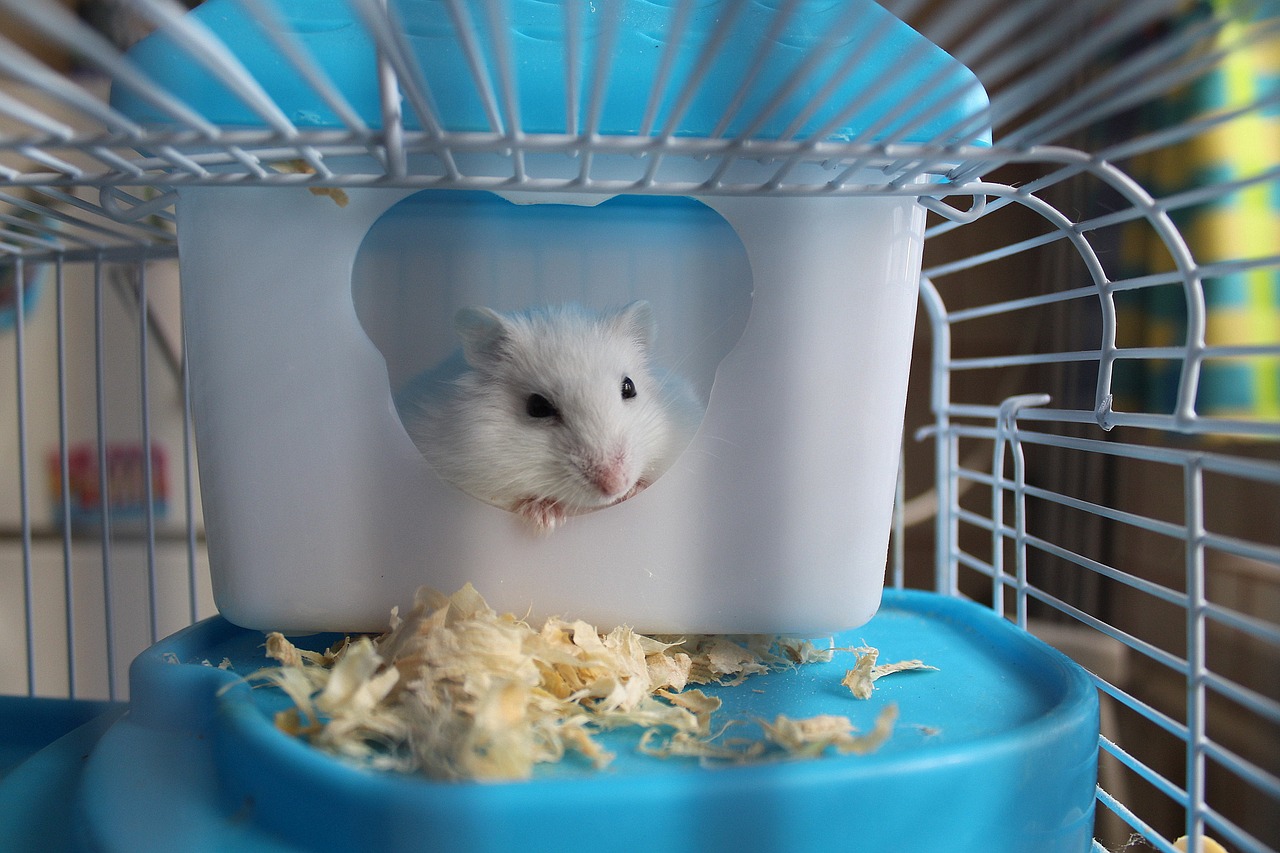

Even though they are a species of a mammalian creature that is small in terms of size, do not mistake it for them needing a small amount of space. It is a rookie mistake to choose a small cage for these little balls of fur. The need a lot of ample space. This is because they can easily get quite aggressive when they do not have a good amount of space. They appoint specific areas for different activities and are quite territorial. They also love to be active and move around. They need to exercise since inactivity will affect their health.

Even though they are a species of a mammalian creature that is small in terms of size, do not mistake it for them needing a small amount of space. It is a rookie mistake to choose a small cage for these little balls of fur. The need a lot of ample space. This is because they can easily get quite aggressive when they do not have a good amount of space. They appoint specific areas for different activities and are quite territorial. They also love to be active and move around. They need to exercise since inactivity will affect their health. It is no secret that hamsters are curious creatures. They really like to roam around, and some of them can even break out of their cages out of curiosity. This can be a problem. When choosing a cage for your beloved little pet, you need to make sure that it can be locked securely. These little creatures are escape artists. Therefore, you need to consider the safety and security measures when you are choosing a cage for your little furry friend to live in.…

It is no secret that hamsters are curious creatures. They really like to roam around, and some of them can even break out of their cages out of curiosity. This can be a problem. When choosing a cage for your beloved little pet, you need to make sure that it can be locked securely. These little creatures are escape artists. Therefore, you need to consider the safety and security measures when you are choosing a cage for your little furry friend to live in.…